So you’ve gotten a new job at a tech startup in Jakarta. Congratulations! Apart from the usual benefits of working for startups such as a casual working atmosphere and the right to wear t-shirts to work, you often hear people talk about “equity” or “stock options.” What do they mean by that and why is it a big deal?

We sat down with Anna Thiphavong, Senior Systems Architect at Narvar, a B2B startup in San Francisco, who has worked at multiple early-stage startups. She shared with Xendit employees what she knows about Equities and Stock Options.

What is Equity?

Equity is ownership of a company in the form of stocks. A company’s equities are divided and owned by many people, like a pie. A portion of that pie owned by the founder, another portion by investors, and another portion by employees. Stock options are a common form of equity awarded to startup employees. They are a way for you to be an owner of the company, not only an employee.

Popularized by technology companies in Silicon Valley, equity is a way for startups to attract, retain, and motivate employees. If you own a part of the company and the company does well, you will benefit directly because the stocks are valued higher. Have you heard about the early employees of now-famous companies like Google and Amazon? They worked at these companies when they were small in the hope that they would become big in the future. They were rewarded by stock options, which after an IPO or an acquisition became much more valuable.

Different types of equity

Three types of equity commonly seen in tech companies include Incentive Stock Options (ISOs), Restricted Stock Units (RSUs), and Employee Stock Purchase Plan (ESPP). They are commonly part of a startup employee’s salary and compensation plan.

- Incentive Stock Options (ISOs): ISOs give the option for employees to buy a company’s stock in the future at a discounted or low price, also known as the strike price. This is the most common type of equity in tech startups, especially early-stage ones.

- Restricted Stock Units (RSUs): RSUs are company stock that are automatically given to the employee after a certain time period. There is no need to purchase the stock. This type of equity is common in very large startups or companies that have already done public with an IPO. Examples include Uber, Google, Facebook, and other larger companies.

- Employee Stock Purchase Plan (ESPP): ESPPs allow employees to purchase company stock at a discount. Typically found in publicly traded companies, ESPPs are less common than ISOs and RSUs in the technology industry.

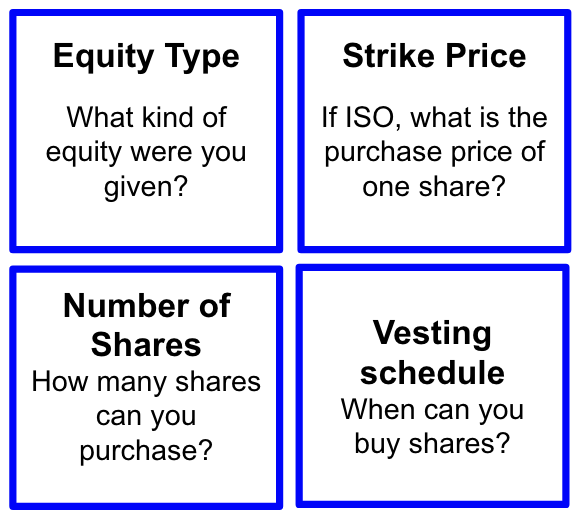

Each stock options package has four components:

Let’s look at an example:

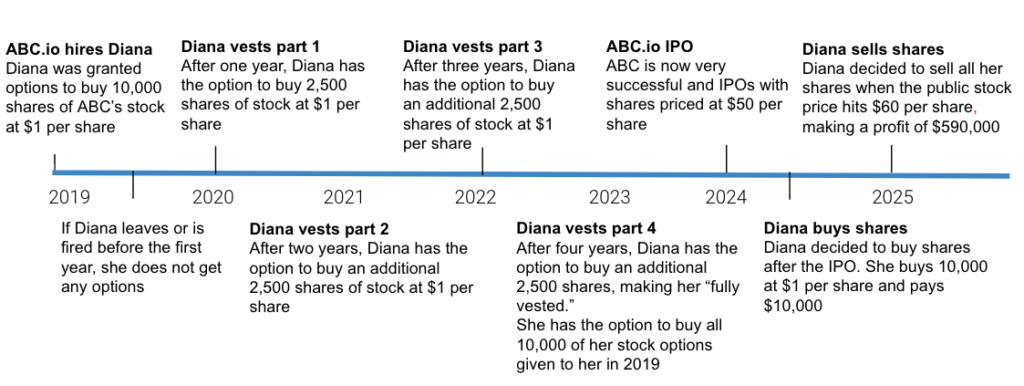

Diana is a new employee at the early-stage startup ABC.ai. As part of her compensation, she was awarded the option to purchase 10,000 stocks for $1, vesting over four years with a one year “cliff.”

Let’s break it down:

- Equity Type: What kind of equity was Diana given? ISO

- Strike Price: If ISO, what is the purchase price of one share? $1

- Number of shares: How many shares can Diana purchase? 10,000

- Vesting Schedule: When can she buy the shares? 2,500 after her first year of employment (the “cliff”), 2,500 after her second year, 2,500 after her third year, and 2,500 after her fourth year

What is the value of the stock options to Diana?

- We can calculate the cost to buy all the shares:

- $ Strike Price x # of Shares = $1 x 10,000 = $10,000

If Diana stays four years at the company, and the value of each share is $60 when she sold them and her strike price is $1 when she bought them, then Diana can have a profit of $590,000 before taxes. Anna did not discuss tax implications because each country has its own laws.

- Calculate the value of the stock options:

- ($ Share Price x # of Shares) – Cost to buy = ($60 x 10,000) – $10,000 = $590,000

If Diana does not stay at the company for four years, the number of shares she can purchase will be lower so she will have a lower profit as well.

Here’s Diana’s example in a timeline:

What do I need to think about when deciding to buy shares in my company?

There are three questions to ask yourself before deciding:

- Do I believe in the company’s future?

- Do I have the money to buy the shares?

- Will the company IPO or be acquired in the near future?

In the case of Diana, she decided to only buy shares after the IPO. The actual rules around when you can buy your shares depends on each situation. But in general, if your company has an IPO or an acquisition happening, most people wait until the event has happened. This because you know the public price per share of the company stock. In the United States, there are also tax implications that might be different than in Indonesia.

What do I need to think about for selling shares?

As with buying and selling individual company stock, there are lots of factors to think about. For startup employees, it is usually not possible to sell shares until either an IPO or an acquisition has happened. The exception to this rule is a secondary event, or when stock option holders can sell their shares to new investors of the company before an IPO or an acquisition. If your company has this event coming up, they will typically share it with employees.

But as long as the price per share is higher than the strike price, you will come out with a profit.

Working at a startup can be both risky and rewarding. Stock options are one of the ways that startups reward employees for their choice. If you want to learn more about stock options for your situation, contact your company’s HR or legal team for more information.